财务常见问题

The GST calculation formula is Tally GST 计算公式Tally

How is the GTO calculated GTO怎么计算的

How is actual income calculated 实际收入怎么计算

*The Allinpay payment amount and Allinpay backend data are inconsistent. 后台Allinpay支付金额和Allinpay后台数据不一致

Daily Report 日结单

-

+

首页

How is actual income calculated 实际收入怎么计算

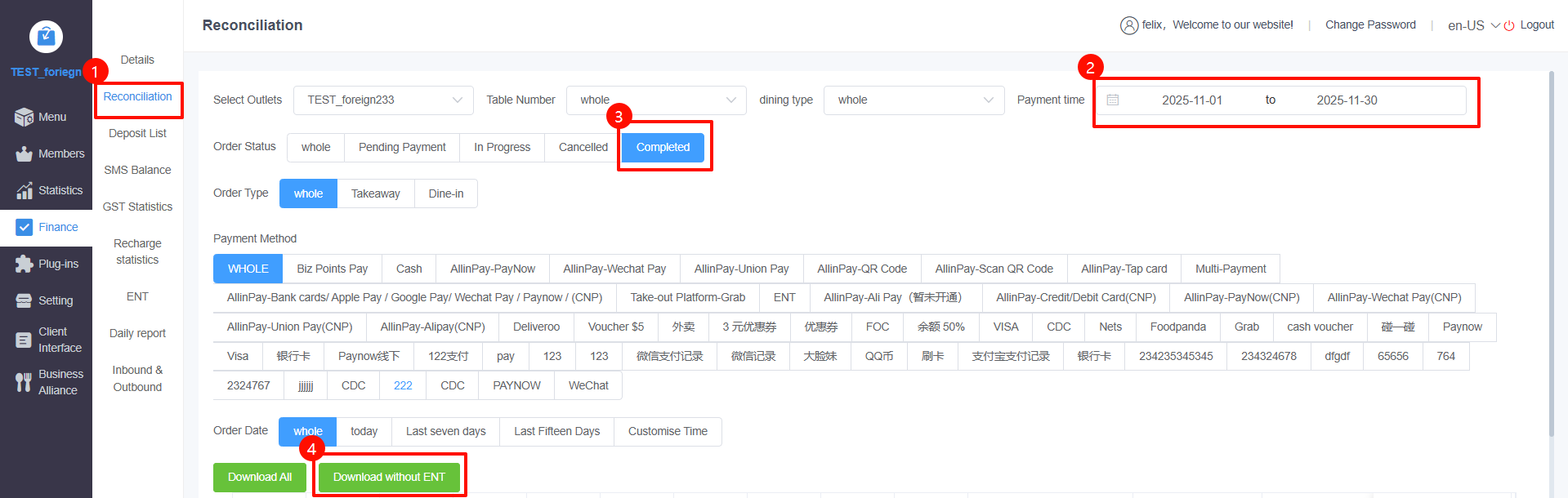

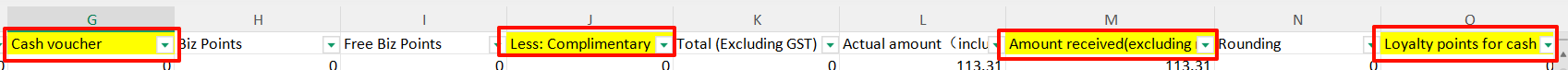

**This document explains that you can view the actual income,The calculation formula is: "Actual income = Net operating amount - Use of gifted business points. 此文档讲解如可查看实际收入,计算公式为‘实际收入=营业金额净值-使用赠送的商业积分’** ## Operation process 操作流程 ### 1.Export data 导出数据 According to the image, export 'Completed Orders' and 'Orders without ENT' within the query period 根据图片,导出查询时间内‘已完成的订单’且‘不含ENT的订单’  ### 2.Calculate actual income 计算实际收入 **actual income=G2+M2+O2-J2** **实际收入=G2+M2+O2-J2**  M2: Actual income (excluding refund amount) G2: Use the value of the cash coupon (GST will be charged for the portion paid by the cash coupon) J2: Gift Business Points (GST is not charged for the included Gift Business Points when paying with Business Points) O2: Consumption points deduction (GST will be charged for part of the deduction at the final payment) M2:实际收入(不含退款金额) G2:使用现金券值(现金券支付的部分会收取gst) J2:赠送商业积分值(使用商业积分支付时,包含的赠送商业积分部分不收取gst) O2:消费积分抵扣钱(在最后支付时,抵扣部分金额,会收取gst)

pos

2026年1月8日 13:47

转发文档

收藏文档

上一篇

下一篇

手机扫码

复制链接

手机扫一扫转发分享

复制链接

Markdown文件

PDF文档(打印)

分享

链接

类型

密码

更新密码