财务常见问题

The GST calculation formula is Tally GST 计算公式Tally

How is the GTO calculated GTO怎么计算的

How is actual income calculated 实际收入怎么计算

*The Allinpay payment amount and Allinpay backend data are inconsistent. 后台Allinpay支付金额和Allinpay后台数据不一致

Daily Report 日结单

-

+

首页

Daily Report 日结单

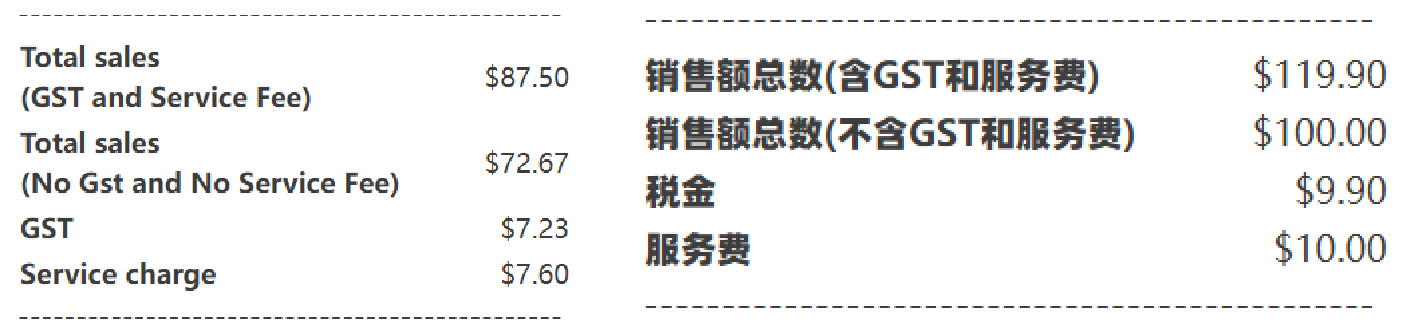

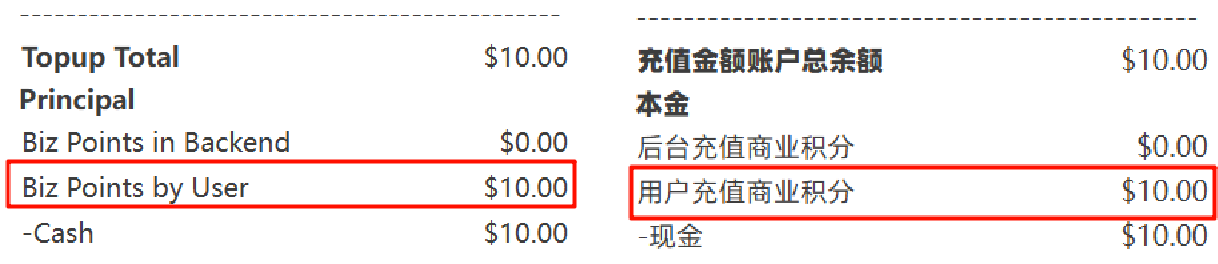

**This article explains how to calculate the fields in the daily statement of financial viewing, which is convenient for viewing and calculating during financial reconciliation 本篇讲解财务查看的日结单中的字段计算方式,方便在财务对账时进行查看、计算** ## Calculation formula 计算公式 **以下公式是根据筛选/查看门店的营业时间段内统计的数据,如果当天下单时间有误/筛选了错误的时间,则会与其他财务数据对不上** ### Turnover amount 营业金额 | Field name | Field explained | Calculation formula| | --- | --- | --- | | Total Rev |The sum of all original prices of all orders (excluding top-up orders, ENT payment orders, and cash voucher payment parts, but including used deposits, not displayed if not used)| Total Rev=All Original order price-Cash voucher-ENT orde+The used deposit | | Various discounts | The sum of the discount reduction amounts used for all orders | Various discounts=Sum of discounts used per order (excluding voucher discounts) | | Total refund amount | The sum of the refunded amounts in the order| Total refund amount=Total refund amount=Sum of refund amounts | | Net operating value| actual amount received, (but due to a lot of marketing interactions, the net turnover here cannot be used as the base for inverting GST) | Net operating value=Total Rev-Various discounts-Total refund amount | | 字段名称 | 字段解释 | 计算公式 | | --- | --- | --- | | 营业金额总数 | 所有订单原价总和(不包含充值订单、ENT支付订单、现金券支付部分,但包含已使用的押金,未使用则不显示) | 营业金额总数=所有订单原价-现金券-ent订单+使用的押金 | | 各类折扣 | 所有订单中使用折扣减少金额的总和 | 各类折扣=每笔订单中使用的折扣总和(不含现金券折扣) | | 退款金额 | 订单中,退款的金额的总和 | 退款金额=退款金额总和 | | 营业金额净值 | 实际收到的金额,(但由于有很多营销互动,此处的营业金额净值不能用做于倒算GST的基数) | 营业金额净值=营业金额总数-各类折扣-退款金额 |  ### 销售额 | Field name | Field explained | Calculation formula | | --- | --- | --- | | Total sales(GST and Service Fee) | The actual income includes GST and service charges, but due to the influence of various factors, it cannot be directly used as the base for inverting GST| Total sales(GST and Service Fee) = Net operating value| + Cash voucher+ Amount offset by consumption points - Biz Points Cost | | Total sales(No Gst and No Service Fee)| ctual income excluding GST and service charges | Total sales(No Gst and No Service Fee)=Total sales(GST and Service Fee)-GST-Service charge | | GST | The sum of the amount of GST in all orders | GST collection: Tax = The total amount of GST in all orders; Including GST: Tax = total order amount calculated backward| | Service charge | Sum of GST service charges on all orders | Service charge=The sum of the service charge amounts across all orders | | 字段名称 | 字段解释 | 计算公式 | | --- | --- | --- | | 销售额总数(含GST和服务费) | 包含GST和服务费的实际收入,但由于各类因素的影响,不能直接作为倒算GST的基数 | 销售额总数(含GST和服务费) = 营业金额净值 + Cash voucher(现金优惠券的优惠金额) + 消费积分抵扣现金 - 商业积分消费赠送值 | | 销售额总数(不含GST和服务费) | 不包含GST和服务费的实际收入 | 销售额总数(不含GST和服务费)=销售额总数(含GST和服务费)-税金-服务费 | | 税金 | 所有订单中GST的金额总和 | 收取GST:税金=所有订单中GST金额总和;包含GST:税金=订单总金额倒算 | | 服务费 | 所有订单中GST的服务费总和 | 服务费=所有订单中服务费金额总和 |  ### Biz Points 积分充值 The amount of the user's deposit will not be recorded in the 'Order Payment Method Details', so when calculating the total fees charged by the payment method, you need to pay attention to whether there are Biz Points 用户充值的金额,不会记录在‘订单支付方式明细’内,在统计支付方式共收取的费用时,需要注意是否有充值积分  ### GTO | GST collection |Calculation formula | | --- | --- | | Charge GST / Contain GST | ((Sum of actual paid amounts in the order - Refund amount - ENT payment amount - Gift value of business points spending) / (1 + GST tax rate)| | NO GST | Sum of actual payments in the order - Refund amount - ENT payment amount - Business Points consumption bonus value | | GST收取情况 | 计算公式 | | --- | --- | | 收取 gst / 包含gst | (订单中实付金额总和 - 退款金额 - ent 支付金额 - 商业积分消费赠送值) / (1 + 税率) | | 不收取gst | 订单中实付金额总和- 退款金额 - ent 支付金额 - 商业积分消费赠送值 |

pos

2026年1月13日 10:25

转发文档

收藏文档

上一篇

下一篇

手机扫码

复制链接

手机扫一扫转发分享

复制链接

Markdown文件

PDF文档(打印)

分享

链接

类型

密码

更新密码